By John Ross

China would in all circumstances have increased its lead in economic growth over the U.S. in 2025. But the impact of Trump’s tariff announcements will slow the U.S. economy and therefore greatly increase China’s lead. This will have a significant impact internationally in the tariff war which Trump has launched and is therefore a major fact in judging the international situation.

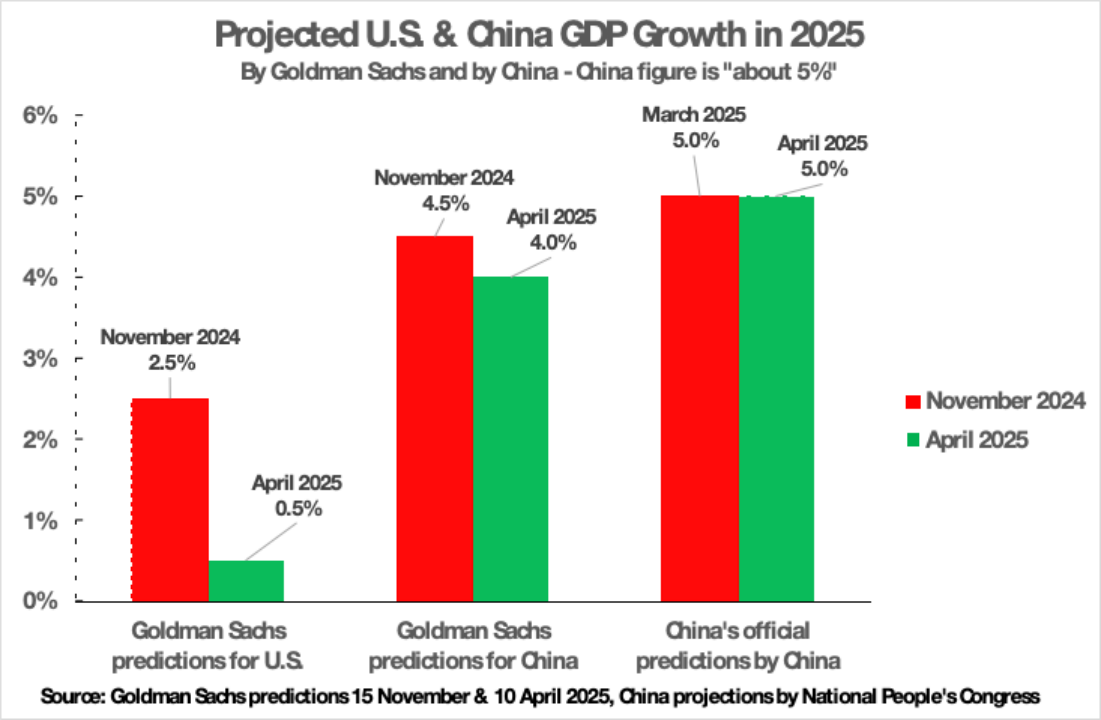

To take simply one economic prediction from the U.S., for example, as recently as last November, Goldman Sachs predicted that China’s economy in 2025 would be growing at 2.0% faster than the U.S. But in its new 10 April forecast Goldman Sachs almost doubled China’s GDP growth lead this year to 3.5% faster than the U.S.. This projection was made even before the announcement that China’s economy in the first quarter grew by 5.4% year on year.

In relative economic terms, Goldman Sachs previously predicted China’s economic growth in 2025 would be 80% higher than the U.S., now it predicts China’s economic growth will be 800% that of the U.S..

But Goldman Sachs analysis is simply in line with those of other major U.S. economic analysts. China, and other countries, therefore, need to understand as accurately as possible the full scale of this impact.

It confirms China’s analysis that, of course, the tariff war launched by Trump is a “lose-lose”, which China does not want – and it would be preferable for the Trump administration to return to the path of reason, and win-win co-operation. But the outcome of the first clash in this war confirms a clear victory for China in that battle as U.S. analysts have clearly themselves concluded.

The slowing U.S. economy in 2025.

It is important to understand that the U.S. economy was going to slow down in 2025 even before Trump launched his ill-judged tariff announcements. The reason for this is that in the recent period, as the U.S. recovered after Covid in an economic upswing of the business cycle, the United States had been growing at well above its medium/long term growth rate.

To understand the consequences of this, it should be noted that the five-year moving average annual U.S. GDP growth rate is 2.4% and its 10-year moving average is 2.2%. However, in the last four years, as the U.S. recovered from Covid, its annual average GDP growth had been 3.6% - in 2023 and 2024 it had been respectively 2.9% and 2.8%. Therefore as U.S. recent growth had been above the trend determined by its medium/long- term factors, the U.S. economy would have slowed down in 2025 even without Trump’s tariff announcements. A detailed analysis of this was given in my article “Trump 2.0 and China – the real situation of the U.S. economy”.

Making a comparison of China’s growth to that of the U.S., in 2024 China’s economy grew 5.0% and the U.S. economy 2.8%. That is, China’s economy grew 2.2% more rapidly than the U.S. - or, put in other terms, China’s economy was growing 80% faster than the U.S.

If China hits its about 5.0% growth target in 2025, and the U.S. economy slows from 2.8%, therefore China’s growth lead over the U.S. would have increased in any case.

But it is important to understand how greatly Trump’s tariff announcements, by reducing U.S. growth expectations, has therefore increased China’s economic growth lead compared to the U.S. This is shown sharply even in estimates made by forces biased in favour of the U.S. and against China. This change will have a significant effect on perceptions of the international situation.

The increasing growth gap between China and the U.S. in 2025

As already noted, a good example of this process is that by leading U.S. investment bank Goldman Sachs. As recently as November 2024 Goldman Sachs was projecting U.S. 2025 GDP growth at 2.5% and China’s at 4.5% (Goldman Sachs rejected the view China would hit its own about 5% target for 2025). On 10 April, after Trump’s tariff announcements, Goldman Sachs instead forecast China’s growth in 2025 as 4.0% and the U.S. at 0.5%. This Goldman Sachs estimate was even in the case that the U.S. escapes a recession –Goldman Sachs estimates the possibility of a worse trend, of a U.S. recession, as 45%.

Therefore, in November Goldman Sachs estimated that China’s economic growth in 2025 would be 80% faster than the U.S. Now it estimates China’s growth will be 800% of the U.S. Even if this were to be somewhat exaggerated as an outcome, the slowdown in the U.S. will be much more severe than in China – if China’s economy slows down at all.

U.S. economists’ analysis of its economic prospects

It is important to understand that Goldman Sachs is typical of U.S. estimates. For example the Atlanta Federal Reserve Board’s estimate of U.S. GDP in the first quarter of 2025 - its “GDP Now” analysis – made on 14 April is a contraction of 2.4% on an annualised basis. Again, even if this is exaggerated, and economic fundamentals do not indicate that there will necessarily be such a severe slowdown, the sharp slowing of the U.S. economy is clear in such a projection.

U.S. media itself is primarily focussing on the issue of whether the U.S. economy will merely slow sharply or enter an actual recession – although this is not the most crucial question.

Thus the Wall Street Journal, under the self-explanatory headline “Economic Outlook Dives Just Three Months Into Trump’s Term”, published a survey of 64 leading U.S. economists carried out during 4-8 April. As this was a survey of a wide range of economists, in a very mainstream U.S. publication, it is worth quoting in detail. It found:

The consequences for China

Not too much attention should be paid to the details in these U.S. projections. For reasons analysed in full in my Guancha article “Trump 2.0 and China – the real situation of the U.S. economy”it is entirely possible to predict the medium/long term growth of the U.S. economy – because it is so closely correlated with the percentage of net fixed capital formation in U.S. GDP. But it is very difficult to predict purely short-term U.S. economic growth as numerous factors affect this.

It was for this reason that it could be, and was, predicted that the U.S. economy would slow down in 2025, as it had been growing for several years above its medium/long term growth rate. But it is not possible from fundamentals to predict exactly how serious this U.S. slowdown in 2025 will be. Numerous secondary factors will affect this situation which therefore must be analysed as they develop. However, four major conclusions, with important implications for China, can already be drawn.

First, whether there is a merely a U.S. economic slowdown in 2025, or there is an actual recession, is not the most important issue. Consequently, while the U.S. media may attempt to present this as the decisive dividing line, claiming it is a “great success” if the U.S. economy escapes an actual recession, that is not all the key issue - and the Chinese media should not be drawn into an error of believing that it is in discussing this either domestically or internationally. It is entirely secondary for international comparisons whether the U.S. economy enters an exact technical recession, that is two quarters of negative growth, or whether its economic growth merely becomes slower. What is clear and crucial is that in 2025 China will substantially increase its economic growth lead compared to the U.S..

Second, this U.S. economic slowdown, which was going to take place even before Trump’s tariff announcements, showed that statements from outlets like The Economist, claiming that the U.S. is "leaving its peers ever further in the dust," or from the Wall Street Journal describing China as having "a stagnant economy," were either deliberate lies, propaganda distortions, or failures to investigate the facts. These facts have now fully confirmed this. It was rather disgraceful that some sections of the Chinese media repeated such propaganda as serious economics rather than analysing the actual facts.

Third, the present author has written numerous articles analysing the U.S, economy in the last years refuting the methods of impressionism seen in both the U.S. and sections of the Chinese media. The latter not merely factually greatly exaggerated U.S. economic growth but, even within that framework, failed to distinguish the normal speedier growth in the upswing of a business cycles, which is necessarily temporary and will, and has been, followed by slower growth – leading to the wrong conclusion that a serious speeding up of the U.S. economy was taking place. The medium/long term growth of the U.S. continues to be entirely correlated with its level of net fixed capital formation in GDP – as shown in “Trump 2.0 and China – the real situation of the U.S. economy” and numerous other articles. The recent events confirm yet again that It is very important that impressionistic methods of misanalysis of the U.S. economy are abandoned and instead objective analysis of the factors that actually determine U.S. economic growth are used.

The international perception of China’s response

Fourth, China’s policies are, of course, an issue to be decided by China and by the CPC, not by non-Chinese. Nevertheless, as a major power, China’s policy affects other countries, and in turn their response affects China and this is noted by them. In this situation it is clear that China’s accurate judgement has had a considerable positive impact not only objectively but in the widespread international perception that Trump suffered a major defeat in the first battle of the tariff war he launched – as shown not only in the turmoil on U.S. financial markets, with severe falls in the prices of both U.S. shares and bonds, but still more significantly in the sharp downward revision of U.S. projected economic growth in 2025.

China’s emphasis on economic security, that is a correct judgement that the U.S. would carry out an aggressive policy, and therefore ensuring that China’s supply chains and other vital economic functions were protected, was shown to be entirely correct - as against those who had illusions in the “benevolent” intentions of the U.S.

China’s judgement that what was crucial was ensuring its own development, and refusal to believe exaggerated propaganda about the speed of growth of the U.S. economy, was shown to be entirely justified – as analysed above, a slowdown in the U.S. economy in 2025 is not due primarily either to any actions by China or even to Trump’s tariffs but to the predictable operations of the fundamental factors affecting the growth of the U.S. economy and their normal working out in the business cycle.

It is therefore clear that China did not have to take any actions to damage the U.S. even if it had wished to, which it didn’t. The U.S. economy slowed due to its own internal problems and what China had to do was concentrate on its own development. The clear and firm response of China to Trump’s tariff aggression, which was made possible by its accurate analysis of the situation, ensured a widely perceived victory of China in the first battle of Trump’s tariff war. This success will be objectively strengthened in 2025 as the U.S. economy slows and China’s lead in economic growth over the U.S. increases.

Unfortunately it is only the first battle in a war

It would be pleasant to be able to predict that, due to this loss in the first battle, Trump will now see sense, abandon the damaging tariff war, and return to sensible “win-win” cooperation which would be in the interest of the U.S., China, and other countries. This would be in the interests of the U.S. people, who will suffer most from the further slowdown in the U.S economy which Trump’s tariffs have imposed.

But, unfortunately, it would not be accurate or realistic to expect this. The evidence is that at present the Trump administration is determined to continue attacks on China, in order to attempt to block China’s economic development, and this will only be stopped if the U.S. suffers further defeats if it attempts the same policies. Therefore, the Trump administration has suffered a defeat in the first battle, but the only realistic assessment of the situation is that the U.S. has chosen for the present a continuing war, and new manouevres will be attempted by the Trump administration to attempt to overcome the consequences of this initial setback.

China’s victory in the first battle of this tariff war was of course carried out in the interests of the Chinese people. But its outcome was in the interests of numerous other countries – because it showed Trump the severe penalties the U.S. will pay for launching a trade war, it therefore created greater opposition in the U.S., and forced Trump to delay even the attempt to impose some of the tariffs he proposed. The fact that China’s lead in economic growth over the U.S. will increase in 2025 will further exert pressure on the Trump administration.

It is therefore very greatly in the interests not only of China but of other countries that China shows the same great clarity and preparation in this entire tariff war as in the first battle.

* * *

This article was originally published in Chinese at Guancha.cn.

John Ross is Senior Fellow at Chongyang Institute for Financial Studies at Renmin University of China. He was formerly Director of Economic and Business Policy for the Mayor of London. The views don't necessarily reflect those of BeijingReviewDossier.